dupage county sales tax vs cook county

The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

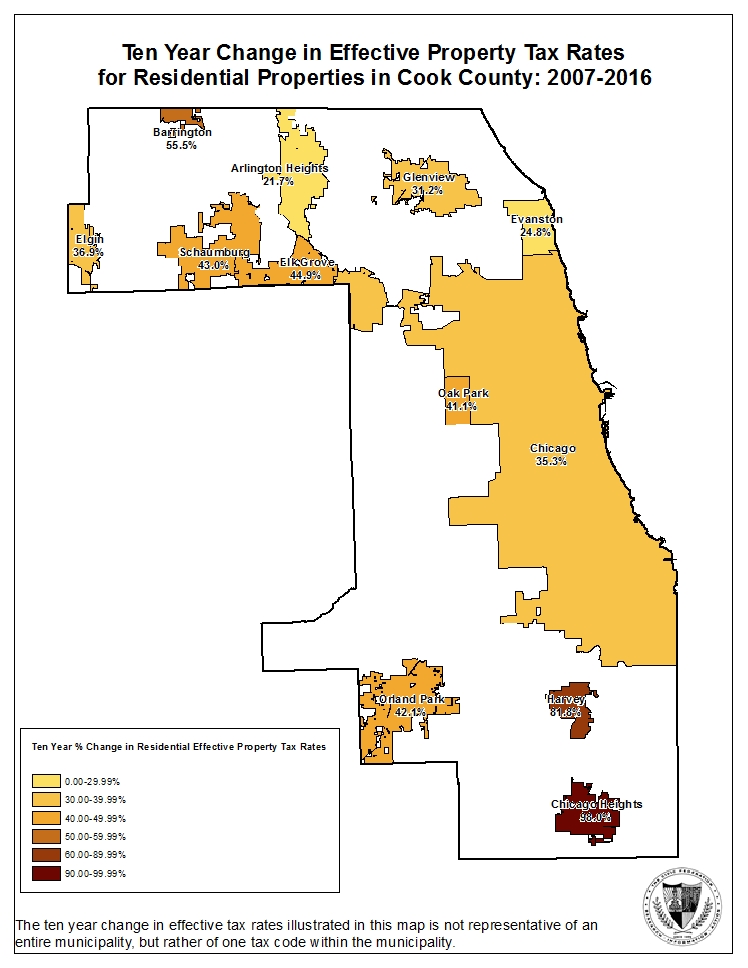

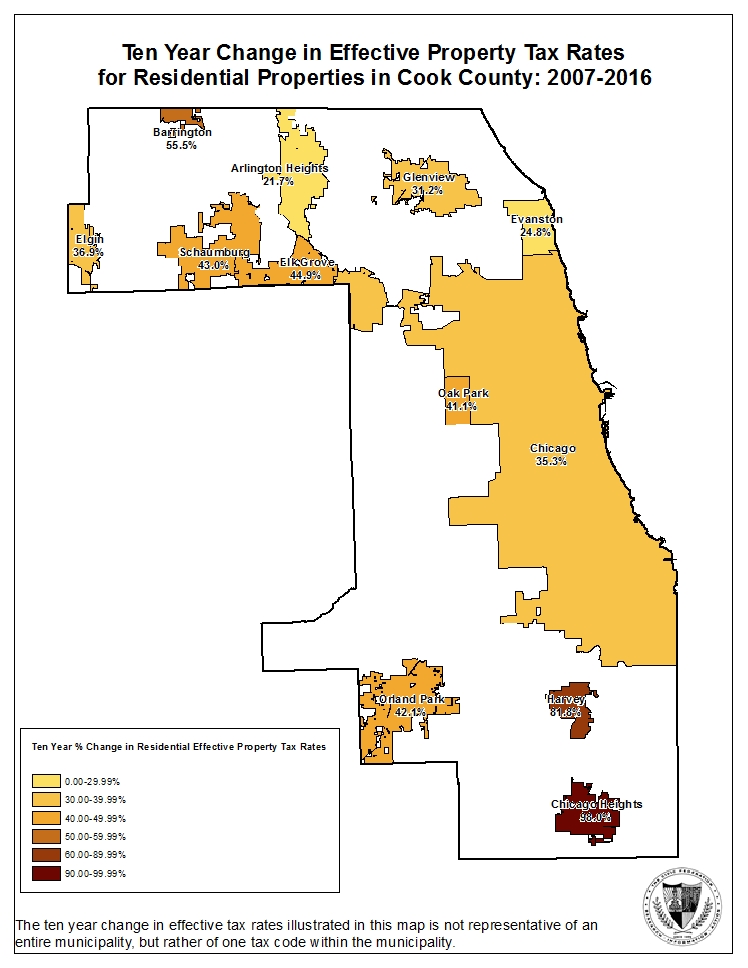

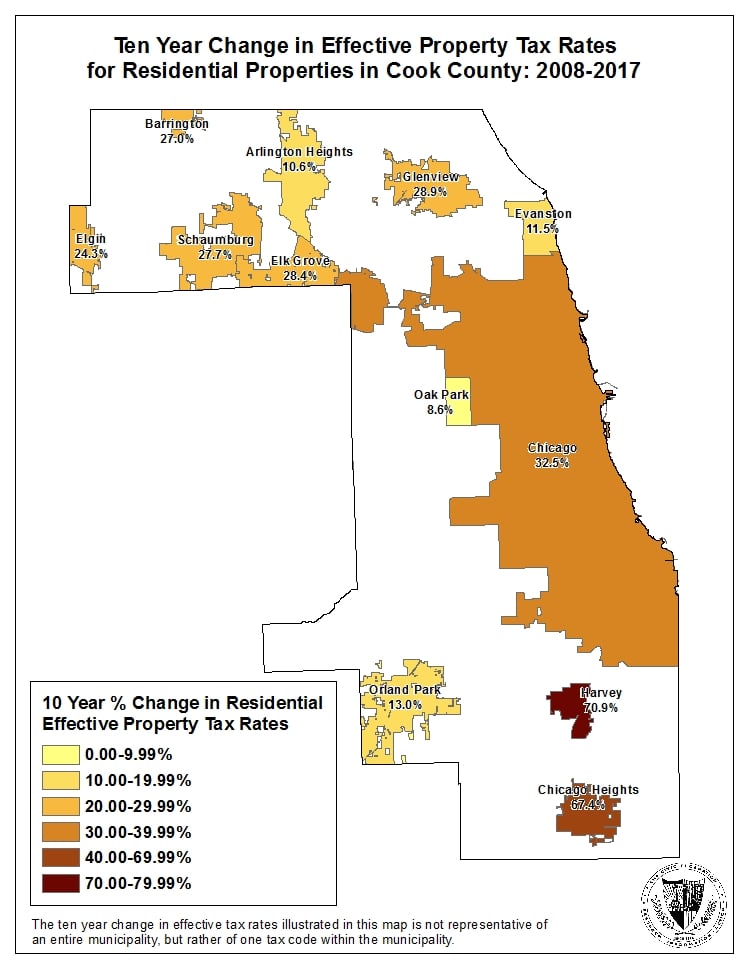

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Illinois relies more than Indiana on individual and business income taxes.

. I live in Cook for accessibility to Chicago- expressways and train stations. Almost all of Chicago lies in Cook County. The Illinois sales tax of 625 applies countywide.

Wishing you the best. A small section of OHare Airport which is part of Chicago is in DuPage County. 24 Champaign County IL.

Cook has more taxes than DuPage. Sales is under consumption taxes. The part of Naperville in DuPage County had a 2005 tax rate of 57984.

Sales tax and use tax rate of zip code 60504 is located in aurora city dupage county illinois state. Metro-East Park and Recreation District Tax The Metro-East Park and Recreation District tax of 010 is imposed on sales of general merchandise within the districts boundaries. Heres how Dupage Countys maximum sales tax rate of 10 compares to other.

In Cook County outside of Chicago its 775 percent. Lake Zurich being in Lake County wouldnt have the heavy sales-tax burden that Cook County communities have. In DuPage County property tax rates vary widely between suburbs with 2005 taxes rates ranging from 82058 for Glendale Heights down to 27896 for Oak Brook.

The sales tax in Chicago is 875 percent. Cook and DuPage Counties. The 2018 United States Supreme Court decision in South Dakota v.

The minimum combined 2021 sales tax rate for Dupage County Illinois is 8. 15 Boulevard Poissonnière 75002 PARIS. What about your take-home pay.

Illinois IL state sales tax rate in DuPage are the lowest in the of. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 375. In DuPage County its 675 percent and.

Dupage county vs cook countyconcord ma zoning bylaws. This is the total of state and county sales tax rates. Dupage County Has No County-Level Sales Tax.

Average Effective Property Tax Rate. Taxes might be slightly less there than in towns to the east but not likely by that much. Tax allocation breakdown of the 7 percent sales tax rate on General Merchandise and titled or.

The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900. 2021 list of illinois local sales tax rates. If your main concern is about sales and property taxes Id suggest looking at Kane County and to a lesser extent Kendall County.

Median Annual Property Tax Payment. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. The base sales tax rate in DuPage County is 7 7 cents per 100.

Illinois taxes individual income at a rate of 495 and business income at 7. The DuPage County Clerk has a list of 2005 taxes rates by community. Has impacted many state nexus laws and sales tax collection requirements.

Look into taxes whether property taxes salestax county tax etc. Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. The counties with the Top 25 highest average rates along with their median home values and median annual property tax payments are listed below the map.

For municipalities within Cook County that impose a local sales tax administered by IDOR the ST-1ST-2 combined rate varies. Interactive Tax Map Unlimited Use. Residents of McHenry Kane and Will pay nearly 6000 on a median property tax bill.

These rates were based on a tax hike that dates to 1985. 1303 rows Illinois has state sales tax of 625 and allows local governments to collect a local. To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925.

As a note the average successful interest rate bid at the Tax Sale held in November 2020 was 2 per each 6 month redemption period for the majority of parcels Tax Buyers Information about the Annual Tax Sale. Georgias sales tax is 4 before county sales tax is added. I go to DuPage for county free tax gas and liquor.

25 DuPage County IL. Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025. A median property tax bill for Lake County residents is close to 7000 while in DuPage County it exceeds 6200.

The dupage county sales tax rate is. The Illinois state sales tax rate is currently 625. 900 St Carlyle IL rate50 cents to a County where the tax Deed Department at 312-603-5356.

Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago. Ad Lookup Sales Tax Rates For Free. For unincorporated areas in Cook County the ST-1ST-2 combined rate is 900.

The base sales tax rate in dupage county is 7 7 cents per 100. While many counties do levy a countywide sales tax Dupage County does not. Nascar miller lite car driver.

Publicerad den 7 februari 2021 av. Dupage county sales tax vs cook county. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due.

DuPage County collects on average 171 of a propertys assessed fair market value as property tax. The Dupage County sales tax rate is 0. Dupage county sales tax vs cook county.

Sales Tax Rate as of July 1 2021 Counties Municipalities Cook County imposes a 175 county home rule sales tax. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes.

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Property Tax Resources In Chicago Il Sarnoff Baccash

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

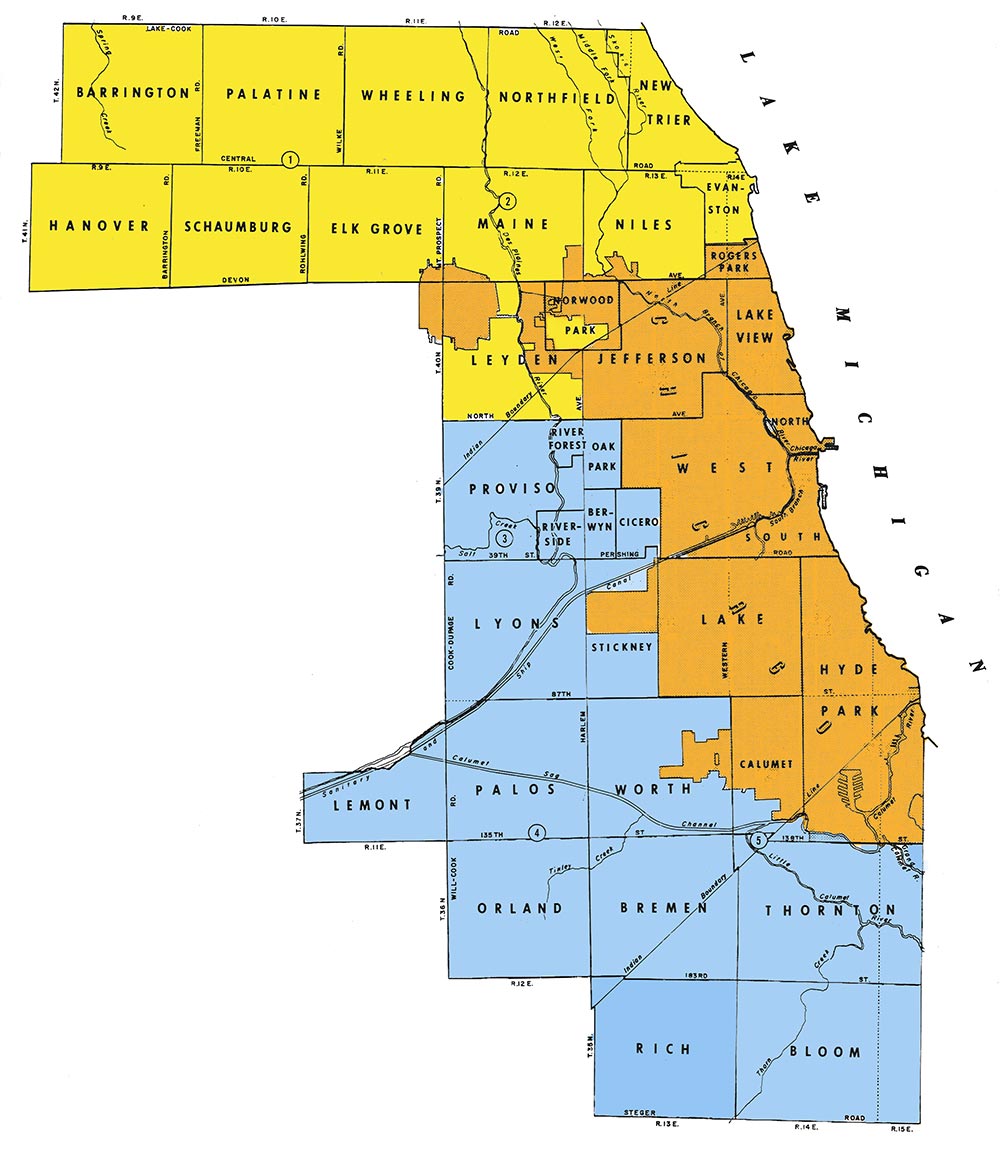

What Cook County Township Am I In Kensington Research

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation